-

Call Us Now 1-844-512-5840

Call Us Now 1-844-512-5840

It is quite tough when a person goes through unexpected situations without any help from others. Unfortunately, sometimes we all have to face such conditions and it can be extremely stressful without any backup plan. This is why it is advised to save a few amounts of money every month. Well, it is not that easy. People who are facing a rough financial patch in their life may have several questions in their minds. You may be thinking, Can I get an emergency loan with bad credit? Or How do I get emergency money? etc. Don’t worry, we are here to help you with Emergency Loans Whitby.

You can apply for online emergency loans in Whitby and get the required money immediately. To apply for an emergency loan, you must have a vehicle that is fully paid for and is not older than ten years. This way you do not have to maintain and remember the different dates of paying loan amount to various lenders.

You must have several questions in your mind such as How can I borrow $50 fast? Which app gives loans instantly? and more. Well, you can get from a small amount to $60,000 from us. Also, you can pre-qualify for the loan in no time.

Anyone in any condition can apply for emergency loans. If you‘re having a bad credit score or no permanent income source, you can still be eligible for the loan. The best thing about this loan is that you can decide where you want to use the funds. We do not impose any restriction on the usage of money, thus, you can cover any cost like paying medical bills, sudden house or vehicle repair, etc.

You can also use an emergency loan:

So if you’re looking to get a loan with minimum requirements and that can help you in your bad times, you should consider emergency title loans.

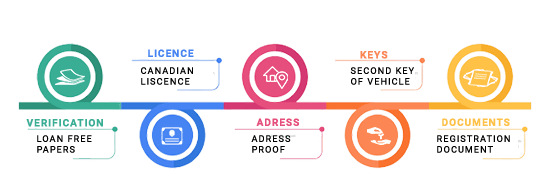

You can get the loan funds on the same day of applying. This makes it the fastest loan and that’s why it is so popular among people. Here are necessary documents needed to process the loan:

Once you are all set with the documents and are ready, you can choose the way you want to apply for the loan. Choose anyone among three available ways:

Emergency loan is the best option to tackle financial problems if one has a poor credit score. Well, the benefits are not limited to it, there are many more advantages that you can enjoy such as